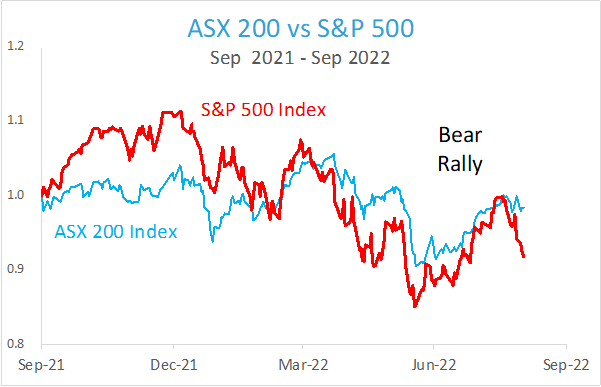

The sudden rise in global inflation put equity markets in Bear Market territory in the first half of the year. But then in the middle of June figures out of the US indicated that inflation appeared to be moderating and the market rallied. But recent comments from the Fed have reinforced the commitment to maintain the current pace of interest rate increases in order to stamp out inflation and are unlikely to reverse course next year. This has put an end to the Bear Rally – defined as a sharp, short-term rebound in share prices amid a longer-term bear market decline. Too fast, too high, too soon… investors saw the crescent but may have missed the whole of the moon.

2022 to Date

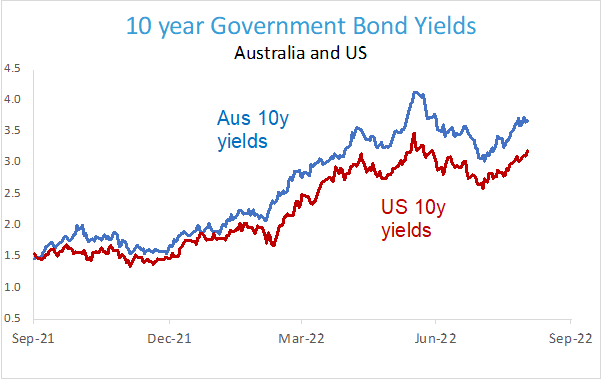

The first half of the year was marked by falling stock prices and rising bond yields, ending one of the longest bull markets seen for decades. Between March 2009, the start of the recovery from the GFC, and December 2021 the Australian market gained 280% in total return, while the US market – powered by the large tech stocks – had a total return of 740%.

Towards the end of 2021, the early signs of a marked increase in global inflation were evident, although initially central banks dismissed the inflation data as “transitory” – principally due to bottlenecks in global supply chains caused by the COVID-19 pandemic.

Inflation turned out to be higher and more persistent than the central banks, and the market for that matter had expected. Markets quickly re-priced expectations of future inflation, which was further compounded in February by the Russian invasion of Ukraine, which caused food and energy prices to spike.

Between the 1st of January 2022 and the middle of June the Australian market fell by 11.3%, the S&P 500 was down and the NASDAQ, the measure of tech stock performance, was firmly in bear territory and down just over 30%.

But markets turned the corner in mid-June. Economic data out of the US indicated inflation was starting to moderate. Key inputs oil and gas were coming off their highs despite the continuance of the Ukraine conflict. Markets rallied on the assumption that inflation would not be as high as thought earlier, and therefore central banks would be able to slow and moderate the future path of rate rises.

Throughout July, and most of August, stock markets around the world started to climb. Both the Australian and US stock markets were up by more than 10% over the period. Bond yields too came off their peak and started to fall, resulting in positive bond returns for the first time in 2022. Hard-hit bond investors finally saw some relief as the global bond market returned 4% between June 15th and July 18th.

But this may well have been a bear market rally. This refers to a sharp, short-term rebound in share prices amid a longer-term bear market decline. Bear market rallies are treacherous for investors who mistakenly come to believe they mark the end of an extended downturn.

The tandem movement of rising stock and bond prices began to diverge in mid-July, as bond markets began to re-price their expectations around future cash rate timing and the persistence of inflation, and began creeping back up to their mid-June highs. For a while, the equity markets ignored the signals from the bond market and continued the bear rally.

The End of the Bear

The stock market “bear rally” came to an end on August 26th when at the Jackson Hole Economic Policy Symposium, Fed Chairman Powell, commented that “Restoring price stability will likely require maintaining a restrictive policy stance for some time.”

Bond markets had pretty much anticipated this would be the case and yields marginally moved upwards on the news. However, equity markets apparently were taken by surprise. When they saw perceived glimpses of recovery in mid-June, they may have risen too fast, too high, too soon. Stock markets saw the crescent, but it seems the central banks have more to say before we see the whole of the moon.

The economic outlook is once again cloudy as Fed officials have indicated they’re not keen to stop tightening until they’re sure that inflation won’t flare up again, even at the cost of some economic damage.

As always, economic forecasts do not necessarily indicate the future performance of stock and bond markets. Bond market yields have levelled out, and it is not clear that stock markets will continue to fall significantly from this point, even if slower economic conditions are inevitable. For long-term investors, the best course of action is to stay disciplined in a well-constructed portfolio that has been designed for you by your financial adviser.

Dr Steve Garth (PhD (AppMaths), BSc (MathsPhys), BA (Majoring in History & Politics), MAppFin, GradDipBusAdmin) is an Independent Member of Alman Partners’ Investment Committee.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for GENERAL INFORMATION ONLY. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.