Last week, I attended a fantastic industry webcast that discussed how human emotions can (and often do) influence decision-making.

It got me thinking about the common cognitive biases we see working in the financial advice industry and one that immediately sprung to mind was the “base rate fallacy.” The base rate fallacy (also called base rate neglect or base rate bias) is a mental error in which people tend to ignore the general prevalence of something in favour of individuating information.

Amos Tversky & Daniel Kahneman (the latter of whom won the Nobel Memorial Prize in Economic Sciences in 2002) are the psychologists most famous for uncovering this bias. In an experiment they ran, test subjects were shown brief personality descriptions of several individuals, allegedly sampled at random from a group of 100 professionals – engineers and lawyers. The subjects were asked to assess, for each description, the probability that it belonged to an engineer rather than to a lawyer. In one experimental condition, subjects were told that the group from which the descriptions had been drawn consisted of 70 engineers and 30 lawyers. In the second group, the numbers were reversed (30 engineers and 70 lawyers).

In a sharp violation of basic probability laws, the experiment found that subjects evaluated the likelihood that a particular description belonged to an engineer rather than to a lawyer, by the degree to which they believed the description was representative of the two stereotypes, with little or no regard for the prior probabilities of the categories. In other words, they seemed to completely ignore the fact they had been told the probabilities (70% or 30%) from the outset.

Why is this relevant for investors?

At Alman Partners, we often talk with our clients about adopting an evidence-based approach to investing. To us, this involves bringing the scientific method to the study of financial markets and basing investment decisions on rational reasoning and empirical data, rather than previous experiences, emotions, and intuitions.

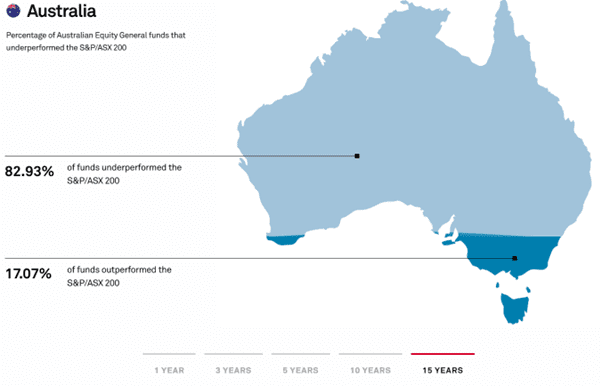

If you’ve met with one of our advisers before, you’ve likely been shown the evidence of the performance of professional money managers and their ability to outperform broad market indices. Material like the SPIVA® report has persistently shown that managers who are able to outperform their benchmarks are in the minority (see Exhibit 1 below). For investors hoping to identify and invest in ‘winning’ managers in advance, the odds of being able to do so (i.e., the base rate probability) are severely stacked against you.

Exhibit 1 – SPIVA Scorecard Results

Source: SPIVA | S&P Dow Jones Indices (spglobal.com). Data as of June 30, 2022.

Despite the evidence, we often see many investors continue searching for winning funds, completely ignoring the fact that the probability of achieving success is so low. Their desire can stem from some previous success they’ve had in picking past investments, or information they’ve received from a respected third party. We would argue that this line of reasoning is individuating information and often leads them to completely ignore the data on the historical probabilities.

What can we do to avoid our mental mistakes?

To avoid committing the base rate fallacy, we believe all investors (including financial advisers) need to work on paying more attention to the base rate information available to us. We also need to recognise that previous individual experiences are not reliable predictors of future outcomes. We think working with a third-party fiduciary, like a financial adviser, can help investors make more rational decisions and ensure that emotions are not the sole factor influencing our financial decision-making.

James Alexander (GradDipFP, MFinP, BBus [Fin, Mgt]) is an Employee of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to

obtain financial product advice.