Much media commentary in Australia and New Zealand right now is focused on the odds of a recession as higher interest rates curb economic growth. But while commentators often use today’s economic news as a pointer to future market returns, the relationship is really around the other way.

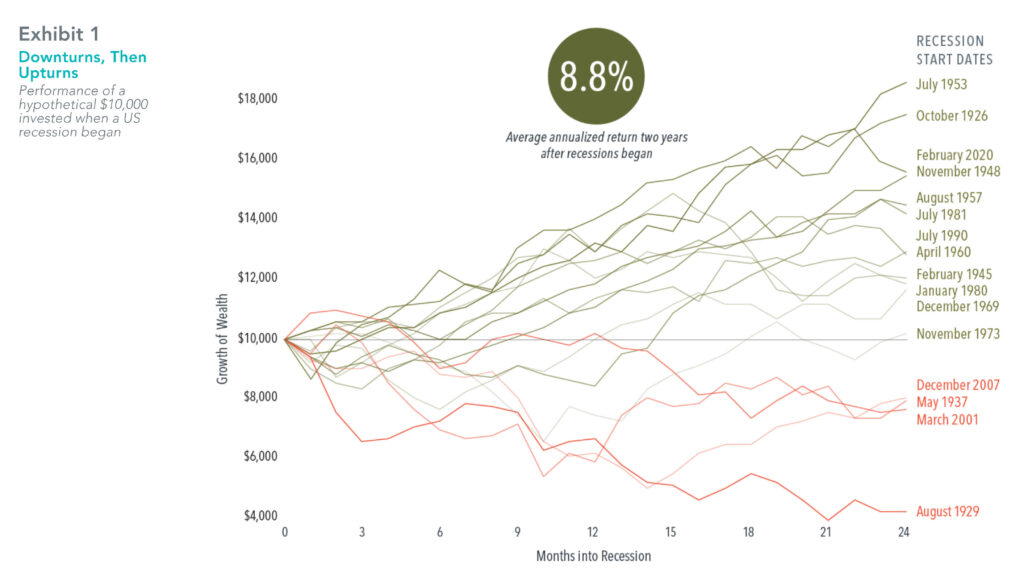

Investors may be tempted to abandon equities and go to cash when there is a heightened risk of recession. But research has shown that stock prices incorporate these expectations and generally fall in value before a recession even begins. Across the two years that follow a recession’s onset, equities have a history of positive performance. Data covering the past century’s 16 US recessions show that investors tended to be rewarded for sticking with stocks. In 12 of the 16 instances, or 75% of the time, returns on stocks were positive two years after a recession began (see Exhibit 1). The average annualised market return for the two years following a recession’s start was 8.8%. Looked at another way, a $10,000 investment at the peak of the business cycle would have grown to $12,145 after two years on average.

Fama/French Total US Market Research Index: July 1926–present: Fama/French Total US Market Research Factor + One-Month US Treasury Bills.

Source: Ken French website.

Recessions understandably trigger worries over how markets might perform. But a history of positive average performance following a recession can be a comfort for investors wondering whether or not they should move out of stocks.

As new information is quickly built into prices, markets already reflect the collective expectations of participants about the odds of recession. For investors, that means that rather than trying to predict a recession, the best response is to trust market prices and stick with your long-term plan.

Source: Dimensional Fund Advisors – Long Term Investors Don’t Let a Recession Faze You

Jason Kirk (CFP® Professional, SMSF Specialist Adviser, GradDip. App.Fin&Inv, B.Econ) is an Authorised Representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for GENERAL INFORMATION ONLY. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.