As interest rates have gone from 0.1% in 2021 to 4.35% at the end of 2023, mortgage holders have been hit hard. But those investors who prefer the security of term deposits to generate income are happy to see returns leap higher over the past 2 years. However, there is one big problem: inflation remains persistent, and it is eating away at the income from the term deposit.

Back at the start of 2023 12-month term deposit rates were on average 3.7%.1 A 1-year term deposit bought in January 2023 would mature in January 2024 and the investor would receive their principal back plus they would have earned a total of 3.7% in income. However, the year-on-year inflation rate was 4.1% on December 31, 2023. That means the term deposit has lost money over the 12 months – inflation has eaten away those predictable returns, and the real return from holding the term deposit is negative.

The term deposit rate is better today – according to the RBA, the average bank 1-year term deposit at the start of January 2024 is 4.55%. The better news is that inflation does seem to be coming down – but not as fast as the RBA would like. While the bond market is implying zero probability of another interest rate rise, the RBA doesn’t think it will return to its core inflation target of between 2% and 3% until 2026, two years away. So relatively high inflation is likely to be persistent for some time yet.

Investors need to be wary of the trap of chasing what looks like acceptable nominal returns that are either cancelled out or become negative once inflation is taken into account. Any investment linked to the cash rate should be seen in the context of inflation. Almost invariably when inflation picks up investors in cash instruments are worse off.

Every aspect of your financial strategy is impacted by inflation, which has a significant and broad influence on your savings and investments. Its core is the gradual and consistent rise in the average price of goods and services over time. Even though this may appear to be a benign economic occurrence at first glance, its effects might be extremely significant.

The purchasing value of your money decreases as inflation sets in. The same amount of money you have today will not be worth the same amount in the future. This poses a significant issue for investors and savers. The way to beat inflation is by investing in a portfolio of risk assets – equities and bonds.

A balanced portfolio has a mix of equities, which are growth assets, and high-quality fixed-interest securities, which are more stable assets. While bond yields plummeted in the aftermath of the global financial crisis, they have returned to a level much more in line with longer-term expectations.

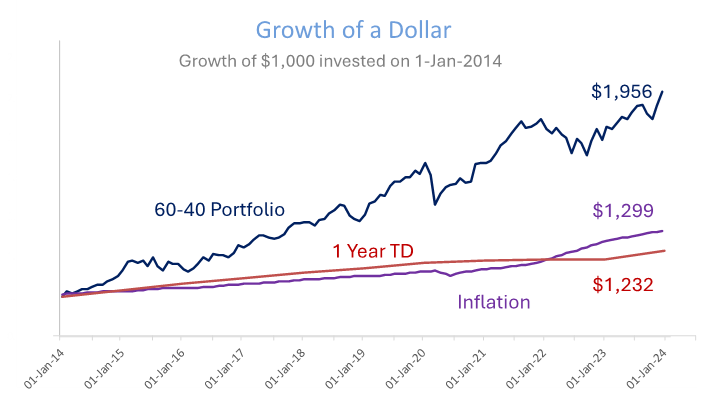

In the chart below we show the growth of $1,000 invested in a one-year TD on January 1st 2014 and the growth of $1,000 invested in a 60-40 balanced portfolio. According to the RBA 1-Year Bank TD’s were on offer for 3.4% at the start of 2014 – that means at the end of the year the TD had returned 3.4%. We can compare that return to the return made by the 60-40 portfolio over the course of 2014, which had an annualised return of 12.95%. We also show the growth of inflation, as measured by the Australian Bureau of Statistics Consumer Price Index. (See Endnote for Source details).

As the above chart makes clear, investing $1,000 into a 1-year term deposit at the start of 2014 and fully reinvesting the principal and interest earned back into the next 1-year term deposit results in $1,232 by January 1st 2024. However, inflation means that your original $1,000 is not worth that today – inflation has meant that the original $1,000 now costs $1,299. That means that just investing in rolling TDs over the last 10 years has meant your wealth has gone backwards.

But the 60-40 Portfolio – very conservative by most Australian standards with 20% in cash – has ended up with $1,956 by January 1st 2024. You have doubled your investment in 10 years and handily beaten inflation. Of course, the investor in the 60-40 portfolio does have to get used to some volatility along the way.

For example, 2022 was a bad year for the balanced portfolio. Both equities and bonds were negative for the year, and the 60-40 portfolio was down -5.4%. Cash was seemingly a better option that year – but a one-year term deposit was paying a measly 0.25% in January 2022, and the year-on-year inflation rate at the end of 2022 was 8%. In other words, you had a real negative return no matter what you did in 2022. And by the end of 2023, the 60-40 balanced portfolio had returned a much more impressive 15%, wiping out the losses of the previous year.

Given the miserable performance of the equity market and the even more miserable bond bear market of 2022, it’s no surprise that today investors who don’t like the volatility of the capital markets are tempted by the security of a term deposit. But as we have seen the headline rate for a 1-year TD at the start of 2023 was eaten away by inflation.

To lessen the negative effects of inflation, it is essential to look for assets that offer returns higher than the inflation rate. This frequently entails investing in long-term wealth-protecting assets like equities, real estate and bonds, which historically have shown the ability to outperform inflation.

If you ignore the effects of inflation, your financial future could suffer greatly. You run the risk of eroding your savings and jeopardizing your long-term financial goals if you don’t take a systematic approach to managing your money in an inflationary environment. As a result, maintaining your financial stability and making sure your money maintains its true value in an ever-changing economic environment require an understanding of the dynamics of inflation and the creation of a diverse investment portfolio that protects against its eroding impacts.

Term deposits provide a secure income. But don’t let inflation eat your lunch.

Dr Steve Garth (PhD (AppMaths), BSc (MathsPhys), BA (Majoring in History & Politics), MAppFin, GradDipBusAdmin) is an Independent Member of Alman Partners’ Investment Committee.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for GENERAL INFORMATION ONLY. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.

1 Data from the Reserve Bank of Australia, https://www.rba.gov.au/statistics/tables/#interest-rates

Sources for Chart:

Term Deposits www.rba.gov.au; Retail deposit and investment rates; Banks’ term deposits 1 Year ($10,000) are averages of the five largest banks’ rates. We take the rate at the start of the year as the actual return 1 year later.

Consumer price index www.abs.gov.au; All groups; Original; Quarterly change (in per cent). Interpolated quarterly data into monthly data.

60-40 Portfolio: 30% MSCI Australia Index (net div, AUD), 30% MSCI World ex-Australia Index (net div, AUD), 20% Bloomberg Global Aggregate Bond Index (hedged AUD), 20% Bloomberg AusBond Bank Bill Index.