Interest rate cuts by central banks towards the end of 2024, in the US, the UK, Canada, New Zealand and elsewhere, have sparked speculation about when the Reserve Bank of Australia (RBA) will follow suit, as well as questions from investors about the implications for their investment portfolios.

On the speculation about rate cut timing, the truth is nobody, including perhaps the Bank itself, can say for sure at this point as the economic data is forever changing. On the implications for portfolios, it’s hard for investors to draw actionable conclusions based on watching the RBA.

This is because the Central Bank’s expected actions are already reflected in market prices, which change every day. So, by the time the RBA does get around to cutting rates, the markets may not react that much because they already will have had time to price the move in.

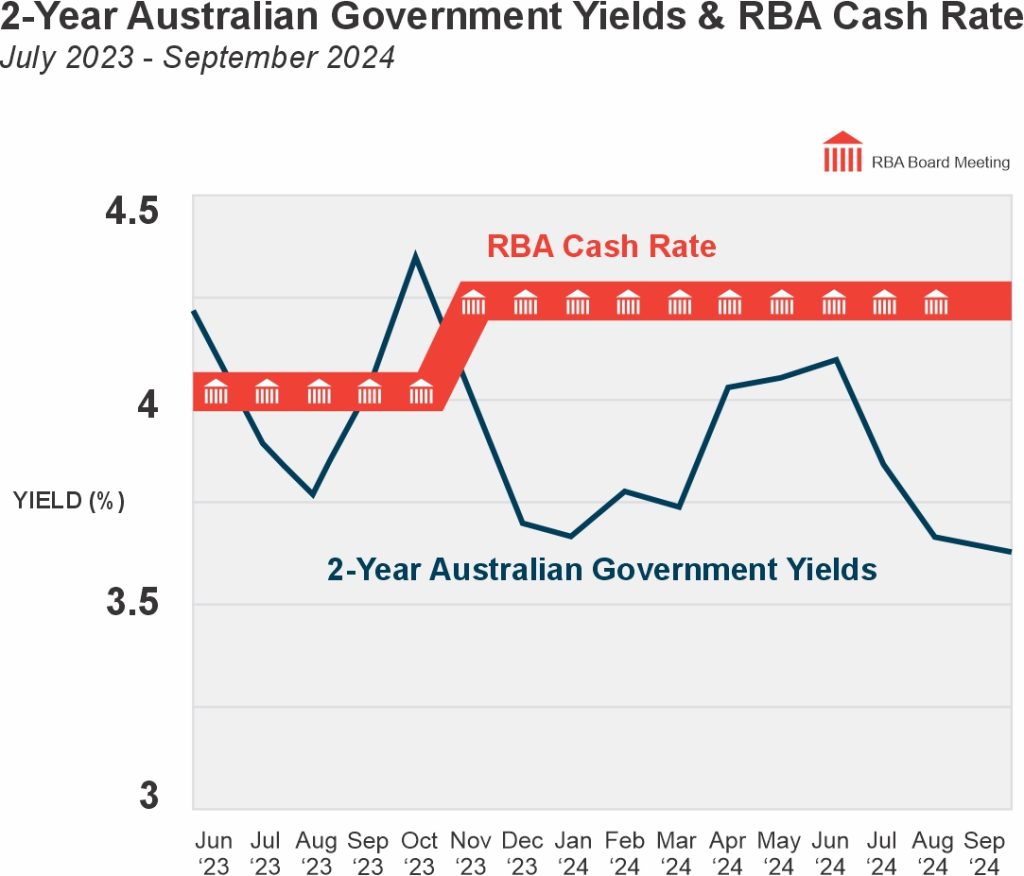

It’s also important to note that the interest rates set by the market vary on factors unrelated to how the RBA sets policy. The Bank’s Board has sat a dozen times since mid-2023 and has raised the official cash rate only once, to 4.35% last November. If you look at the chart below, you can see how the Two-Year Australian Treasury Yield has varied over that same period.

Source: Dimensional Fund Advisors, 2024.

This is a good example of how markets constantly make their own judgements about the timing and size of official rate decisions and why there is little point in second-guessing them. As to the returns on your investment portfolio, these are likely not that closely correlated with the RBA cash rate in any case.

James Alexander (GradDipFP, MFinP, BBus [Fin, Mgt]) is an Authorised Representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for GENERAL INFORMATION ONLY. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.