Why would one of the richest men in the world make this statement time and time again? Because over the long term, most fund managers tend to be pretty poor at picking stocks and underperforming markets. Plus, they are expensive. He is so confident in this fact that in 2007 he bet a collection of hedge fund managers $1 million that a US index fund return over 10 years would beat all of them. He won and donated the money to a charity called Girls Inc.

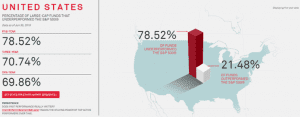

Below are the latest findings of the Spiva Report: 78.52% of US-based active fund managers underperform the market after five years. Closer to home in Australia, that number is 80.79%, in Europe, it’s 77.53%1.

Considering investors can access index returns for extremely low management costs, why would anyone bother trying to pick those managers who beat markets only to have a very high probability that they will get one that underperforms.

After 20 years of educating our clients on the benefits of capturing market returns at a low cost, it is interesting to see that the world has finally caught on. Over the past 12 months, fund inflows into low-cost index investments exceeded the inflows of actively managed investments for the first time.

1https://us.spindices.com/spiva/#/reports

Stephen Lowry (CFP Professional, DFP, FAIM, AIF) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.