You may have heard in the news recently that it will now be tougher to borrow from the bank to purchase a home. Banking regulator APRA has announced mortgage minimum interest rate buffers will increase from 2.5% to 3%. So, what does that mean?

When you apply for a home loan the bank assesses how much you can borrow. Your “serviceability” is not based on current interest rates, but rather the ability to service repayments at a higher level. They need to prove that if interest rates increase, you actually can repay your loan.

When we think about this in the long-term nature of a home loan, you might have that commitment for up to 30 years. That’s a long space of time and interest rates are going to go through many changes and different cycles over this period. If you’re thinking about taking on a large loan and potentially a very long-term loan, make sure that you’re thinking about your ability to service the loan repayments if rates do get back to those higher figures that we’ve seen in the past.

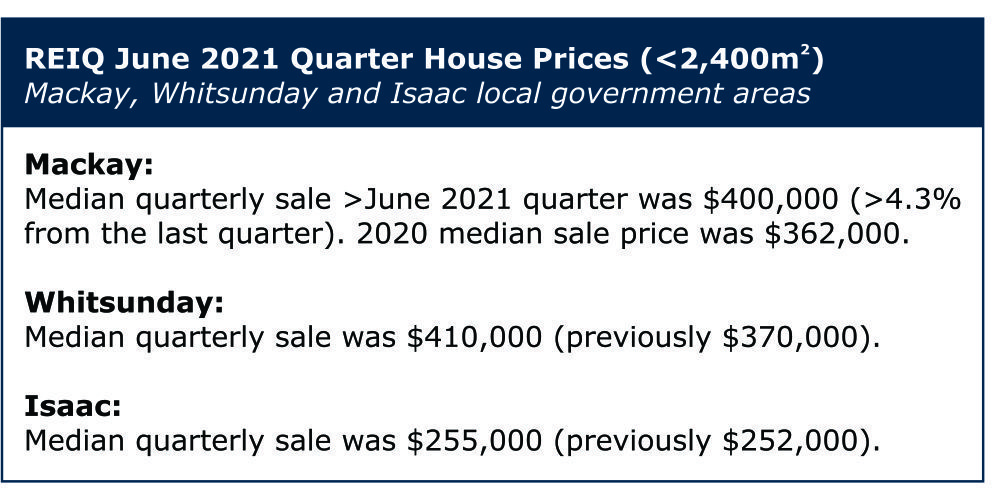

Treasurer Josh Frydenberg recently spoke about debt-to-income levels for households following the increase in house prices. We’ve also seen an increase in the level of debt that people are taking on to purchase property, more of which are owner-occupied rather than investment, unlike the previous property bubble.

Previously measures have been put in place to control lending. The last time was after a boom specifically in investment property lending. This round of controls is targeting debt-to-income levels for households following a near 25% growth in taking on loans that are 6x the family income.

The Government is wanting to restrict lending in those situations, where debt represents such a high proportion of household income. It is however a bit of a catch 22. As house prices increase, obviously the amount that people need to borrow increases as well. You need a higher deposit or to have increased borrowing capacity to be able to get that house, whether it’s owner-occupied or investment.

The ability to take on a loan has become slightly more attractive in recent times for those entering the market, as we’ve had several Government grants to assist, e.g. First Home Buyers, First Home Loan Deposit Scheme. We’ve also had a record low-interest-rate environment.

Considering we are staying closer to home these days, a lot of people are considering upgrades or getting into their first home. Often once that decision is made it can be something that people tend to rush. However, it is important to make sure that you can service that loan before you enter into it, and that comes with a really good savings history. Try setting aside the amount that you would otherwise make on home loan repayments to a separate account for a few months beforehand. This is a good way of showing a bank or broker that you’ve got some good serviceability as they will ask for your banking and savings records to show that you have that capacity.

We at Alman Partners take APRA’s decision as a positive sign because it means that they’re looking to make sure that mortgage holders’ serviceability is going to be there, if and when interest rates rise. After all, the inevitability is that at some point in time they will rise.

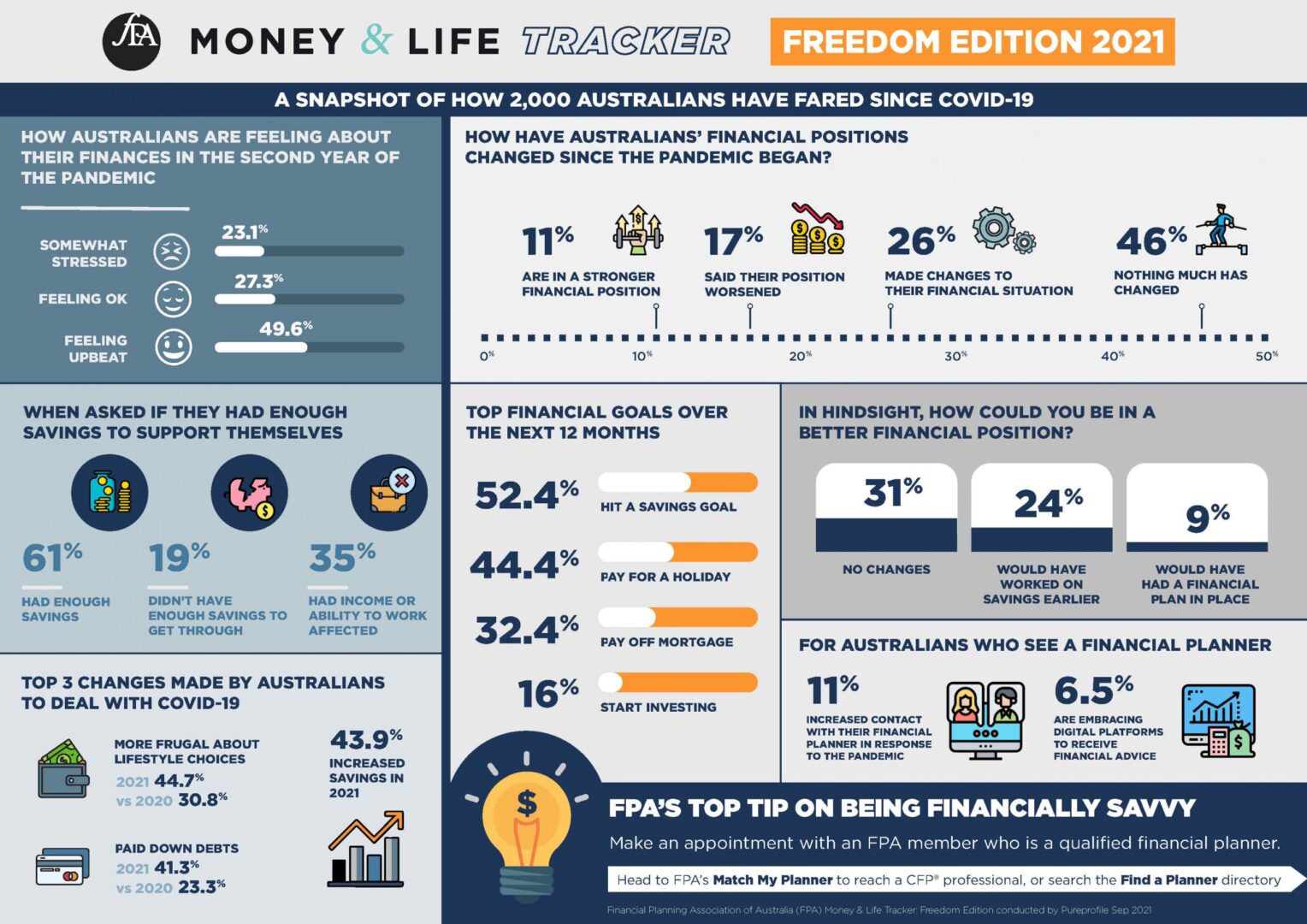

Figures released from the Financial Planning Association (FPA) during the Financial Planning Week earlier this month show that there is a lot of positivity out there around housing and in reducing debt levels. It shows that individuals have been saving more and paying down debt more than they previously did.

As with any large financial decision, there will be an impact on your financial goals. It always pays to discuss these types of big decisions with your Mackay Financial Adviser.

Teneale Laister (CFP® Professional, AFP®, BCom[Fin,FP,Mgt](Hons), ADFS[FP]) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.