WHO IS IT FOR:

YOUNG INVESTORS

or those just starting their investment journey.

PARENTS

wishing to invest for their children’s future.

SMSF DIRECTORS

or Trustees.

MEET OUR INVESTMENT COMMITTEE:

Niyati Khanna

Investment Committee Chair

CFP® Professional, CA, MBA (Finance & Strategy)

Niyati has been one of Alman Partners’ most highly qualified Financial Advisers since 2016 and became an owner of Alman Partners in 2021. Niyati's financial acumen and analytical prowess are second to none. She has 6 years of experience in Investment Banking and a further 8 years in the global financial sector. She currently Chairs the Alman Partners’ Investment Committee and is passionate about delivering strategies based on proven scientific methodologies.

Dr Steve Garth

Independent Investment Committee Member

PhD (Applied Mathematics), MAppFin, GradDipBA, BSc (Mathematics & Physics), BA (History & Politics)

Dr Steve Garth provides his expertise, insights, academic rigour and experience to our Investment Committee around areas such as asset allocation, implementation and the evaluation of investment strategies and investment managers. For nearly two decades, Steve has played a key role in helping grow the Australian arm of global asset manager Dimensional Fund Advisors. During his career, he has managed Australian and global equity portfolios, managed the Asia Pacific trading team and oversaw the introduction of direct market access trading, and for the last 10 years, he specialized in managing the firm’s fixed interest strategies.

Paul Shepherd

Committee Member

CFP®️ Professional, BEng, DipMgt, DFS(FP)

Paul is the Managing Director of Alman Partners, and Senior Financial Adviser with over 11 years of experience in the profession. Paul brings with him a wealth of knowledge from his previous Project Management Career & Engineering degree. He continually seeks improvement opportunities and enjoys the challenges that this brings. Paul is a founding member & currently holds an executive role in the Global Association of Independent Advisors (GAIA) representing Australasia.

Mehak Advani

Committee Member

MAdvFin, CFA Program Level II, MCom (Bus. Admin + Acc.), GradDipFP, BMgt (Fin)

Mehak is currently a Provisional Adviser, having completed her studies and Adviser exam. She has recently completed her Graduate Diploma of Financial Planning, and holds a Master of Advanced Finance from Monash University, alongside being a Level 2 Participant of the CFA Program. She has previous experience in Wealth Management, working as a Client Relationship Manager at a well-known firm in Mumbai. Mehak also holds a Master of Commerce in Business Management & Accounting.

Refer to Provisional Adviser Disclaimer here.

James Alexander

Committee Member

CFP® Professional, MFinP, GradDipFP, BBus (Fin, Mgt)

James spent almost a decade working for a global investment management firm across both their Sydney and Melbourne offices. His key responsibilities as Client Relationship Management saw him primarily focusing on privately licenced, wealth management/financial planning businesses. James consulted with wealth management businesses on building efficient practices whilst providing a successful investment experience to clients. He has a thorough understanding of investment capabilities, investment theory, and performance. James became an owner of Alman Partners in 2023.

HOW IT WORKS:

EXPLORE

Register to access the Investor Portal to explore our portfolios, access the fee calculator, see past performance and access key documents such as the Product Disclosure Statement.

SELECT

Choose a portfolio suited to your needs when you are ready to begin your investment journey.

INVEST

Open an account through a simple online application and begin investing with as little as $1,000.

It’s as simple as 1, 2, 3.

Stay up to date with regular articles by our expert team with Insights and Portfolio Updates. Monitor your portfolio performance online 24/7.

Minimum initial investment: $1,000. No minimum on additional/regular contributions.

To view PDS and other key documents, follow the link above.

AP Direct Invest - Self-Directed Online Investment Service

AP Direct Invest is a self-directed online investment service for those looking to control their own investment decisions, whilst utilising the expertise of award-winning firm Alman Partners and the AP Investment Committee model portfolios. With 40 years of extensive experience managing investments and access to global leading market research, we bring the world of investing to your door.

Choose from 6 low-cost investment portfolios that utilise a range of Exchange-Traded Funds (ETFs), designed to capture market returns in a broadly diversified manner. 2 of these portfolios are designed with environmental, social and governance (ESG) filters. Whether you are looking to begin your investment journey, invest in your future or your children’s, or manage your investment journey whilst capturing a fair rate of return, there is a portfolio for you.

Our approach is evidence-based. We do not pick stocks or try to time markets. Rather our recommendations are based on Nobel-Prize-winning academic research, not speculation or forecasts. This ensures your portfolio is optimised to capture market returns, giving you confidence in your investments.

Where will your journey take you?

PORTFOLIOS:

Select the investment model portfolio that suits your investment needs.

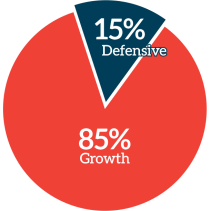

AP High Growth

Investment Objective

The portfolio seeks to maximise long term capital growth opportunities with income distributions being of secondary consequence.

Typical Investor

In general, this portfolio is designed for investors with a long-term investment time horizon of at least 7 years, seeking high levels of capital growth, prepared to accept short to medium-term volatility, and who wish to outsource the construction and management of their underlying portfolio holdings.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETFs designed to capture market returns in a broadly diversified manner, with specific tilts incorporated to target higher expected returns. The portfolio will include limited holdings in cash and listed Australian property with the majority of exposures focused on equities, both Australian and international.

The portfolio targets a 10-year annualised gross return of 9% with an expected negative return occurring on average once every 5 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

| Recommended minimum investment | $5,000 |

| Indicative number of holdings | 6 to 10 |

| Asset allocation ranges (%) |

| Asset type Cash Australian Shares International Shares Australian Property International Property Australian Fixed Interest International Fixed Interest Alternatives Other |

Minimum 0% 50% 20% 0% 0% 0% 0% 0% 0% |

Maximum 5% 70% 40% 15% 0% 5% 0% 0% 0% |

| Management Fee Indirect Cost One-Off Entry Fee |

0.85% p.a. 0.26% p.a. 0.10% |

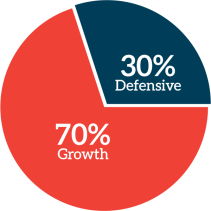

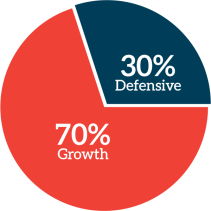

AP Growth

Investment Objective

The portfolio seeks to maximise long term capital growth opportunities by investing in growth assets with a moderate allocation to defensive cash/fixed interest assets.

Typical Investor

In general, this portfolio is designed for investors with a long-term investment time horizon of at least 7 years, seeking high levels of capital growth, prepared to accept short to medium-term volatility, and who wish to outsource the construction and management of their underlying portfolio holdings.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETF’s designed to capture market returns in a broadly diversified manner, with specific tilts incorporated to target higher expected returns. The portfolio will include moderate exposure to cash/fixed interest and listed Australian property, with the majority of exposure focused on equities, both Australian and international.

The portfolio targets a 10-year annualised gross return of 8.8% with an expected negative return occurring on average once every 5 – 7 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

| Recommended minimum investment | $5,000 |

| Indicative number of holdings | 6 to 10 |

| Asset allocation ranges (%) |

| Asset type Cash Australian Shares International Shares Australian Property International Property Australian Fixed Interest International Fixed Interest Alternatives Other |

Minimum 0% 40% 20% 0% 0% 0% 10% 0% 0% |

Maximum 5% 60% 30% 10% 0% 0% 20% 0% 0% |

| Management Fee Indirect Cost One-Off Entry Fee |

0.85% p.a. 0.25% p.a. 0.10% |

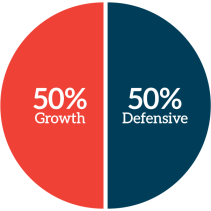

AP Balanced

Investment Objective

The portfolio seeks to maximise medium to long term capital growth opportunities by investing in growth assets with a moderate allocation to defensive cash/fixed interest assets.

Typical Investor

In general, this portfolio is designed for investors with a medium-term investment time horizon of at least 5 years, seeking moderate levels of capital growth with some income assets, and prepared to accept moderately high short to medium-term volatility, and who wish to outsource the construction and management of their underlying portfolio holdings.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETF’s designed to capture market returns in a broadly diversified manner, with specific tilts incorporated to target higher expected returns. The portfolio will be diversified primarily across equities, both Australian and international, with moderate exposure to cash/fixed interest and listed Australian property.

The portfolio targets a 10-year annualised gross return of 8.2% with an expected negative return occurring on average once every 5 – 7 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

| Recommended minimum investment | $5,000 |

| Indicative number of holdings | 6 to 10 |

| Asset allocation ranges (%) |

| Asset type Cash Australian Shares International Shares Australian Property International Property Australian Fixed Interest International Fixed Interest Alternatives Other |

Minimum 0% 35% 15% 0% 0% 10% 10% 0% 0% |

Maximum 5% 45% 25% 10% 0% 20% 20% 0% 0% |

| Management Fee Indirect Cost One-Off Entry Fee |

0.85% p.a. 0.23% p.a. 0.10% |

AP Moderately Conservative

Investment Objective

The portfolio provides a mixed exposure between income and capital growth opportunities but is more weighted towards consistent income distribution.

Typical Investor

The portfolio is designed for investors with a medium-term investment time horizon of at least 3 to 5 years, seeking moderate levels of income and capital growth, prepared to accept short to moderate volatility, and who wish to outsource the construction and management of their underlying portfolio holdings.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETF’s designed to capture market returns in a broadly diversified manner, with specific tilts incorporated to target higher levels of income. The portfolio will be diversified across Australian Equities, International Equities, Property, High Yield Income Securities, Income Securities and Cash.

The portfolio targets a 10-year annualised gross return of 6.4% with an expected negative return occurring on average once every 7 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

| Recommended minimum investment | $5,000 |

| Indicative number of holdings | 6 to 10 |

| Asset allocation ranges (%) |

| Asset type Cash Australian Shares International Shares Australian Property International Property Australian Fixed Interest International Fixed Interest Alternatives Other |

Minimum 0% 25% 10% 0% 0% 35% 5% 0% 0% |

Maximum 5% 35% 20% 10% 0% 45% 15% 0% 0% |

| Management Fee Indirect Cost One-Off Entry Fee |

0.85% p.a. 0.21% p.a. 0.10% |

AP ESG High Growth

Investment Objective

The portfolio seeks to maximise long term capital growth opportunities with income distributions being of secondary consequence. Investment managers seek to eliminate exposure to controversial business activities and prioritise investing in companies that embrace high environmental, social and governance (ESG) standards.

Typical Investors

In general, this portfolio is designed for investors seeking high levels of capital growth, prepared to accept short to medium-term volatility, and who wish to combine traditional investment approaches with environmental, social and governance insights. The portfolio has a long-term investment time horizon of at least 7 years.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETF’s designed to capture market returns in a broadly diversified manner. The portfolio will include limited holdings in cash and listed Australian property with the majority of exposures focused on equities, both Australian and international. Exposure is adjusted to take into account certain environmental and sustainability impacts and social considerations.

The portfolio targets a 10-year annualised gross return of 9% with an expected negative return occurring on average once every 5 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

| Recommended minimum investment | $5,000 |

| Indicative number of holdings | 5 to 10 |

| Asset allocation ranges (%) |

| Asset type Cash Australian Shares International Shares Australian Property International Property Australian Fixed Interest International Fixed Interest Alternatives Other |

Minimum 0% 30% 50% 0% 0% 0% 0% 0% 0% |

Maximum 5% 50% 60% 0% 0% 0% 0% 0% 0% |

| Management Fee Indirect Cost One-Off Entry Fee |

0.85% p.a. 0.33% p.a. 0.10% |

AP ESG Balanced

Investment Objective

The portfolio seeks to maximise medium to long term capital growth opportunities by investing in growth assets with a moderate allocation to defensive cash/fixed interest assets. Investment managers seek to eliminate exposure to controversial business activities and prioritise investing in companies that embrace high environmental, social and governance (ESG) standards.

Typical Investors

In general, this portfolio is designed for investors with an investment time horizon of at least 7 years, who are seeking moderate levels of capital growth with some income assets, are prepared to accept moderately high short to medium-term volatility, who wish to combine traditional investment approaches with environmental, social and governance insights and outsource the construction and management of their underlying portfolio holdings.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETF’s designed to capture market returns in a broadly diversified manner. The portfolio will include moderate holdings in cash/fixed interest and listed Australian property with the majority of exposures focused on equities, both Australian and international. Exposure is adjusted to take into account certain environmental and sustainability impacts and social considerations.

The portfolio targets a 10-year annualised gross return of 8.2% with an expected negative return occurring on average once every 5 to 7 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

| Recommended minimum investment | $5,000 |

| Indicative number of holdings | 6 to 10 |

| Asset allocation ranges (%) |

| Asset type Cash Australian Shares International Shares Australian Property International Property Australian Fixed Interest International Fixed Interest Alternatives Other |

Minimum 0% 25% 30% 0% 0% 0% 25% 0% 0% |

Maximum 5% 35% 45% 0% 0% 0% 35% 0% 0% |

| Management Fee Indirect Cost One-Off Entry Fee |

0.85% p.a. 0.30% p.a. 0.10% |

Documents Required for Application

Individuals: Driver’s Licence or Australian Passport | Company: Australian Company Number (ACN) | SMSF: SMSF details, including ABN or ACN | Trust: Trust Deed.

For all accounts – you will require your bank account details for transfers and deposits.

The AP Direct Invest platform is designed for self-directed investors and does not include any personalised advice.

If you feel your circumstances need full-service financial planning and ongoing support, head to Alman Partners’ Service Overview to learn more about our available offerings.

AP Direct Invest Pty Ltd: Website Disclosure Information (WDI)

AP Direct Invest Pty Ltd is a Corporate Authorised Representative (001295396) of Alman Partners Pty Ltd (AFSL: 222107)

Disclaimer: OpenInvest Limited (ACN 614 587 183 AFSL 504 155) has appointed Alman Partners Pty Ltd (AFSL 222107) as the portfolio manager for various model portfolios it is the responsible entity for. Alman Partners Pty Ltd has prepared this website for general information purposes only. It does not contain investment recommendations nor provide investment advice as to the suitability of the financial product to meet your needs or objectives. We strongly encourage you to obtain professional advice from an accredited financial adviser authorised to provide you with personal financial advice to determine the suitability of the financial product for you. A Product Disclosure Statement (PDS) issued by OpenInvest Limited can be obtained via the OpenWealth service by clicking on the Start Investing link that appears above. You should read the PDS prior to investing as it contains information that will assist you in deciding whether the service is suitable for you and which of the model portfolios is suitable for you. A summary of the six portfolios that are available is provided above. You should refer to the PDS to decide which option may be suitable to your needs and objectives.

To find out more information about Alman Partners Pty Ltd, see above links. Please see our Privacy Policy that describes how we collect and deal with information on persons visiting this website.