Fears of a rapid downturn in the world’s largest economy – a “Trump Slump” – are starting to permeate financial markets. Fears that US President Donald Trump is willing to plunge the US economy into recession to achieve his aggressive trade goals have unleashed panic across global markets, including the Australian Sharemarket. For investors, when markets are in turmoil the best course of action is to stay disciplined.

Until now, many investors have embraced the idea of “US exceptionalism,” which has pushed the S&P 500 Index Sharemarket to record highs, powered the economy, maintained a strong labour market, and placed the country at the forefront of artificial intelligence. But a slew of recent weaker economic data shows the US economy is shrinking fast.

As well as the weak economic data, the US President has failed to allay concerns when warning that Americans may feel a “little disturbance” from the unfolding trade wars and refused to rule out the possibility of a recession. That sparked panic on Wall Street as investors dumped risk assets. The S&P 500 Index extended its sell-off from February to nearly 9 per cent, while the technology-heavy Nasdaq slumped a further 4 per cent.

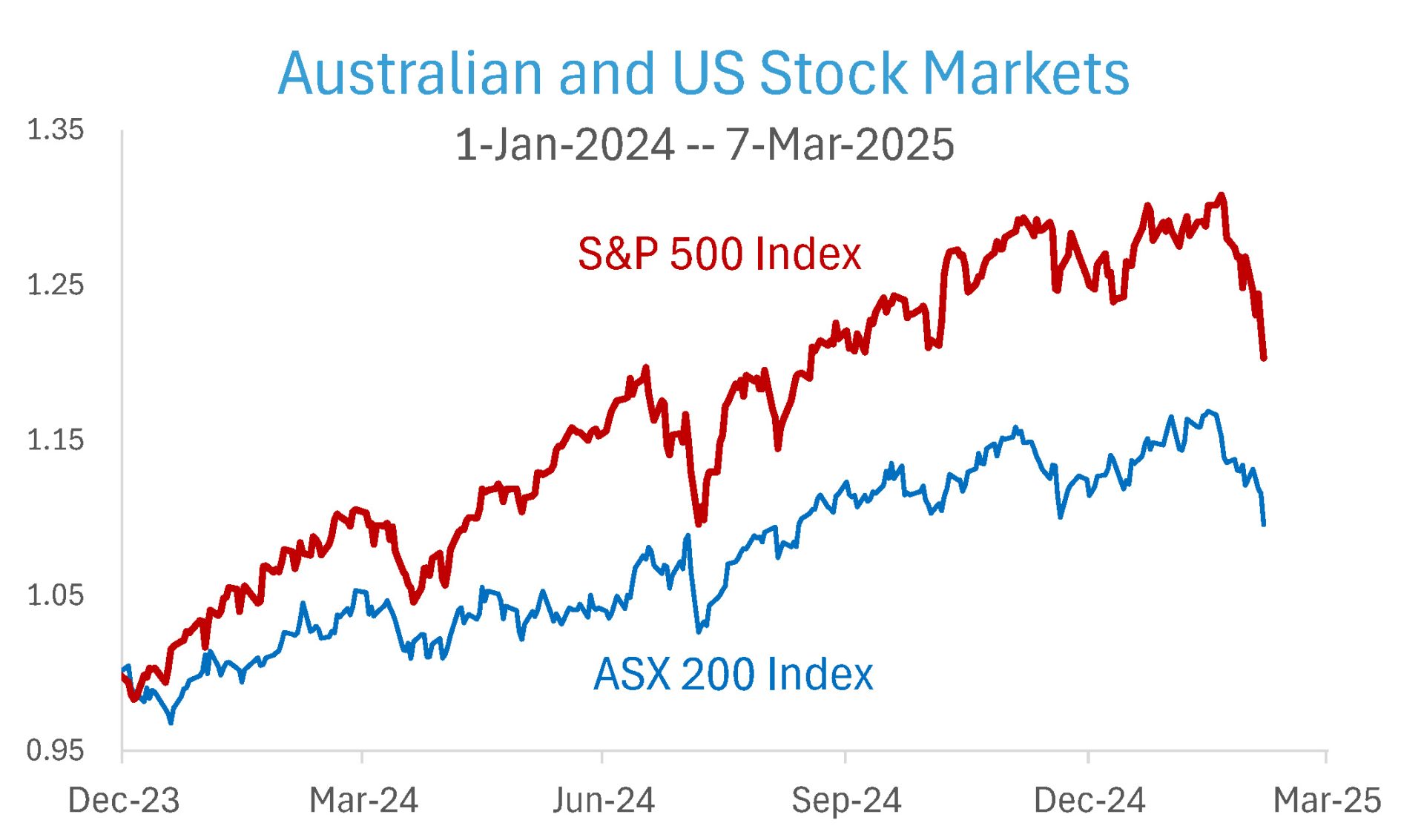

The chart above shows the fall in the US S&P 500 Index and the Australian S&P/ASX 200 Index from the start of 2024 up until March 7th. Both markets hit new highs in the middle of February, but the slowdown since then has been dramatic.

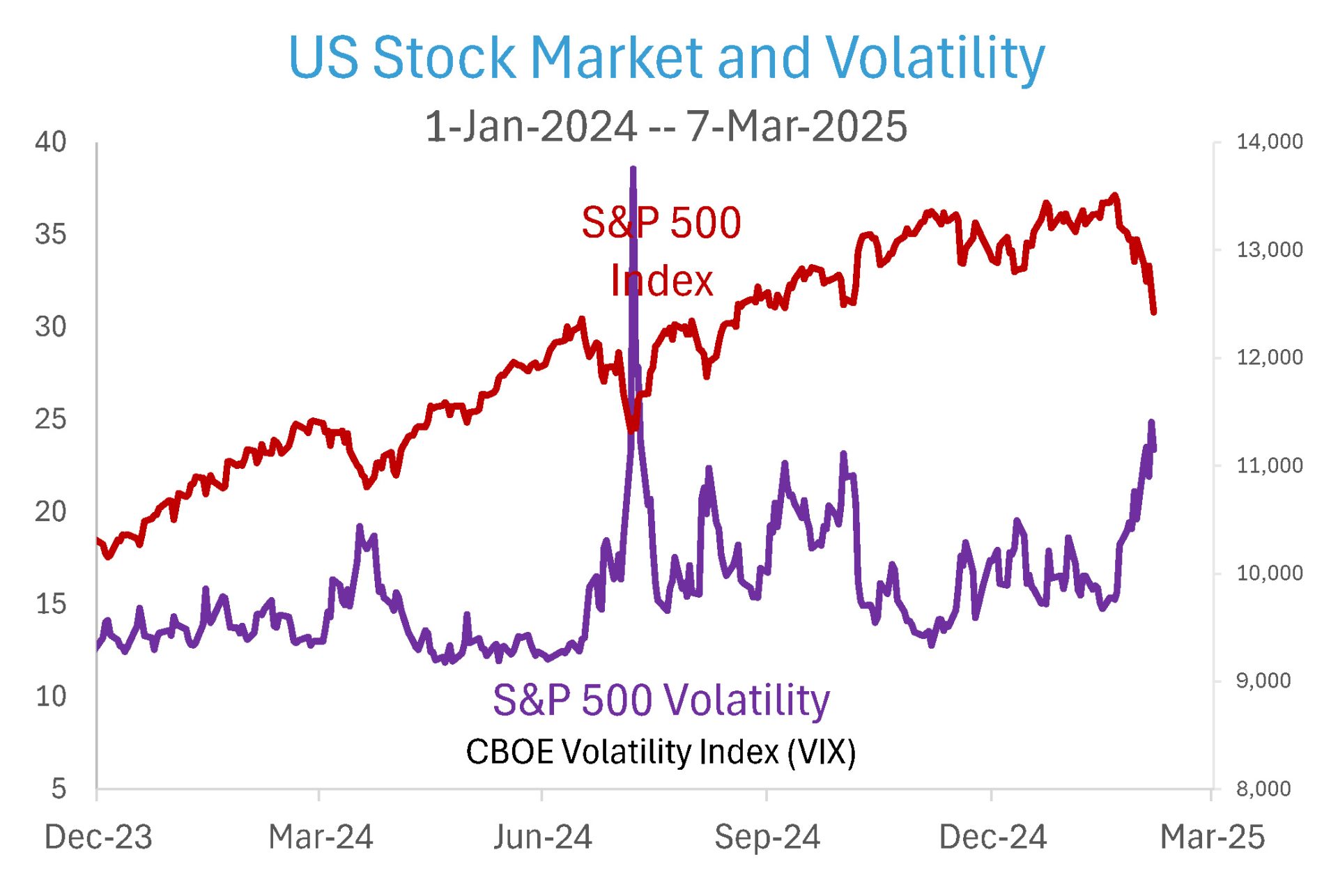

The US market volatility has also spiked as shown in the chart below with the VIX Index – often referred to as Wall Street’s “fear gauge” – jumping to a level last reached during a market sell-off in August. Investor sentiment has dramatically shifted less than two months into the new Administration as the President has rolled out sweeping tariffs on America’s three largest trading partners.

Markets initially cheered Trump’s election victory in November, betting that tax cuts and deregulation plans would extend a two-year bull market. That so-called Trump trade has since unwound amid concerns about the impact on global growth and the prospect of America falling into a recession. The “Trump Bump” has turned into a “Trump Slump.”

While talk of recession seems premature given the strength of the US labour market, there is no question that a slowdown is underway. The Trump administration’s policy agenda – immigration cuts, confusion over tariffs and the push to reduce government spending – collide with an economy that may have had more cracks under the surface than markets were willing to face up to last year.

There are a few points to take from the above charts:

- Volatility is a normal part of investing. Markets go up and down all the time, but over the long run they go up. The best course of action is to tune out the noise from the financial media.

- Right now markets are having a downturn. But last year was a record year for many markets around the world, so we shouldn’t be surprised to see a correction from time to time.

- Trying to time markets is hazardous to your investment goals. No one has a crystal ball to know when the markets will turn. The “Trump Bump” has turned into a “Trump Slump” in the blink of an eye.

- Discipline is rewarded. Market volatility can be worrisome, no doubt. The feelings generated are completely understandable. But through discipline, diversification, and accepting how markets work, the ride can be more bearable.

History has shown that investors who change their portfolios in response to market conditions usually come out worse than they would have by staying disciplined and sticking with the portfolio that was designed to meet their goals.

What matters for individual investors is whether they are on track to meet their own long-term goals detailed in the plan designed for them. It is the long-term returns that count. Remember, volatility is not necessarily a risk. As always, a financial adviser can help put you in a portfolio that will achieve your long-term goals and help keep you disciplined when markets go through their ups and downs.

Dr Steve Garth (PhD (AppMaths), BSc (MathsPhys), BA (Majoring in History & Politics), MAppFin, GradDipBusAdmin) is an Independent Member of Alman Partners’ Investment Committee.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for GENERAL INFORMATION ONLY. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.