When individuals are financially capable, they make financial decisions and engage in behaviours that are in their own best interests, and that help them achieve a financially secure future.

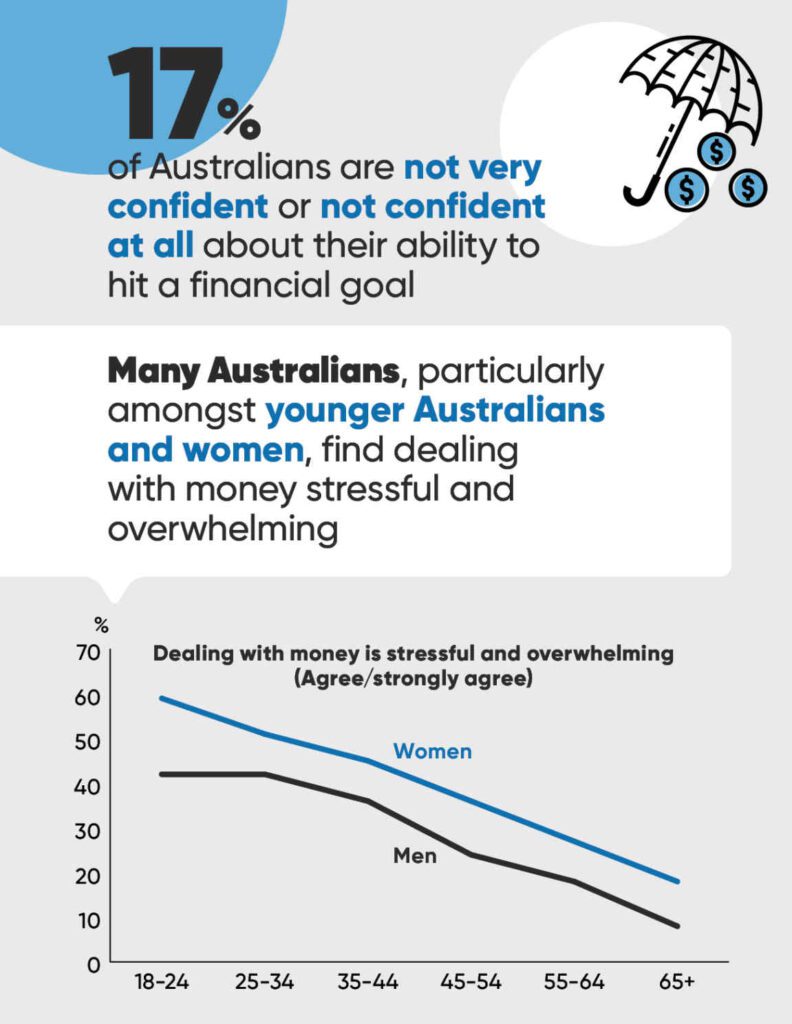

This was the focus of the National Financial Capability Strategy, released by the Australian Government in February, where the statistics showed a large percentage of younger Australians find dealing with money stressful and overwhelming.

This is not surprising as with each new generation when required to make a decision they are overwhelmed, often paralysed by options as more information becomes readily available, making the decision all the more difficult. This is also known as Analysis Paralysis.

So with over 60% of young women and over 40% of young men feeling overwhelmed, how can we help our kids, family and friends to achieve their most import goals?

As the saying goes Knowledge is Power. Empower them by educating them to make smart financial choices. Talk to them. It is ok for them and yourself not to have all the answers, it is actually great for them to know that it is ok to ask if they don’t know the answer.

The Government has launched a website following the release of the Strategy, with helpful tips for parents here and useful tools and information for teens here.

Some areas you can talk to your teens about are:

- How to identify what really is important to them. What do they want to achieve? The importance of having a plan.

- Working and getting paid: What to give an employer when starting work. Explaining superannuation, paying tax and tax returns.

- Making a budget and saving.

- The real cost of purchases: What additional costs to consider, e.g., purchasing a car (purchase price + on-road costs + ongoing).

- Investing: understanding different types of investments, returns, risk and costs.

- Debt: credit cards, loans, pay later options.

- How do you deal with a bad decision and where to ask for help.

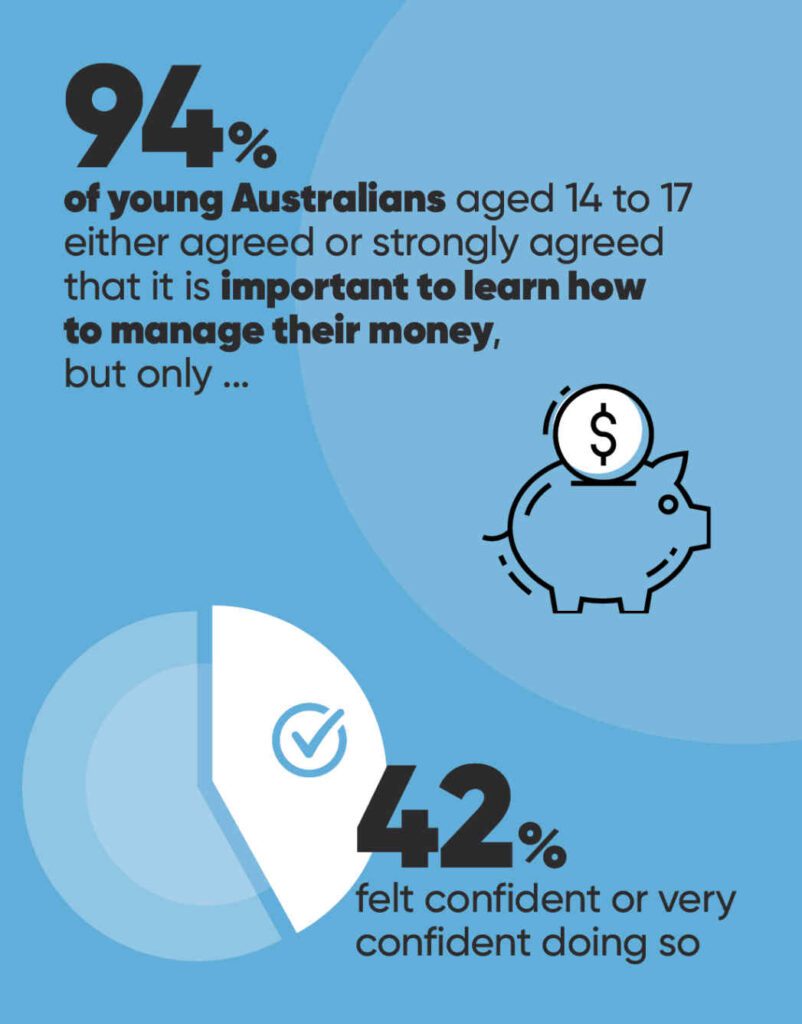

By having these discussions when your children are teenagers, you can help to build the younger generations’ financial confidence and lead and inspire them to achieve their most important financial goals.

Katrina Dhu (GradDipFinPlan, DFS(FP), ADFS[FP]) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.