In 2018 the Royal Commission heard that Scott Pape, the “Barefoot Investor,” had contributed to over $2.5 billion flowing into Industry Super Fund Hostplus via his unsolicited recommendations made in his books and online, shouting out the benefits of this fund.

Considering the following article which we are sharing below, and others recently published in the Age and Australian Newspapers, Mr Pape may have unwittingly put tens of thousands of young Australians superannuation at risk and maybe even the fund itself. Unfortunately, Hostplus is not the only ‘Industry Super Fund’ to find itself facing this potential tsunami.

Stephen Lowry, Director of Alman Partners True Wealth

The below article has been shared by Alman Partners:

A perfect storm to expose some Industry funds

A momentous problem is brewing for some Industry funds with large investments in unlisted assets.

By Chris Brycki (March 27 2020)

Super funds have enjoyed significant inflows over many years underpinned by the Super Guarantee. The main beneficiaries over the past decade have been the Industry funds which were just minnows when the Global Financial Crisis (GFC) hit in 2008.

Under the comfortable assumption of a government-mandated increase in annual inflows, many Industry funds felt that liquidity would never be a problem.

Several of the larger funds have been moving a significant portion of their overall fund assets into illiquid unlisted assets like direct property, infrastructure, private equity and alternatives.

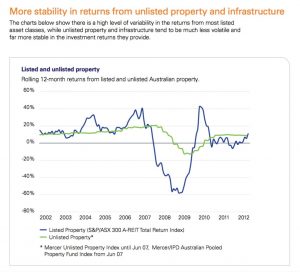

The benefits of this move have been explained to members as a way of mitigating the volatility of market returns.

Source: Australian Super brochure “Comparing listed and unlisted assets”

Many of these Industry funds have been so confident in the valuations and liquidity of their unlisted assets that they have allowed members to freely switch out of funds that include unlisted assets (including some of the largest MySuper funds), into listed assets and cash on a daily basis.

They did not take into account the impact of a rapid 38% fall in the Australian share market, a 34% fall in the listed infrastructure index and a 46% fall in listed property trusts. They certainly didn’t take into account that the government would let their members take out $20,000 before retirement, as has recently been announced.

This has caused a momentous problem for some Industry funds.

Firstly, what is the value of the fund when the member transfers or redeems? The trustees are obliged to value the member’s investment at market. So what if a large portion of the fund is in unlisted investments?

This happens to be the case with the Hostplus flagship Balanced fund which according to Morningstar was worth $39bn at 29 February this year {2020}.

No less than 38% of the fund is tied up in unlisted assets including property, infrastructure, private equity and alternatives. {ed: This is a horrendous position for members who should never have more than 60% in growth assets in a Balanced fund. Hostplus has 99% in growth assets.}

Hostplus helpfully lists on its website the 109 unlisted investments it has made across infrastructure, property, private equity and alternatives. How can the trustee get a handle on how much these opaque investments are worth on a daily basis?

What are they worth now compared to their stated value in February?

A good place to start is the movement in the indices of equivalent assets traded on the share market. You can choose your index, but the broad listed property index dropped 46% from its February highs and listed infrastructure 34%. It is anyone’s guess what the market value of private equity and alternatives might be. But it is reasonable to assume that they are worth a lot less than they were in February.

Unfortunately, it gets worse. As members transfer and redeem, where does Hostplus find the money?

It is a fair bet that there is little liquidity in the unlisted funds and direct assets because most have handcuffs, pre-emptive rights and a long and convoluted sale process.

Hostplus may therefore have to sell down more of their listed domestic and international share portfolios.

Australian shares in the flagship Hostplus Balanced fund were valued at $11bn at the end of January. If they tracked the 38% fall in the index they would be worth around $7.5bn now.

Global equities which were valued at $12bn in January. Since then the developed market index has declined 30% and the emerging market index has declined 25%. If the Hostplus portfolio tracked these performances it is now worth around $8.5bn.

Every time Hostplus sells down listed assets, the weighting of the unlisted and opaque part of the portfolio increases within their Balanced fund.

For the members who haven’t exited, this is an appalling result.

To understand the size of the problem for Hostplus it’s worth looking at their sector fund options which presumedly invest in similar unlisted assets to the Balanced fund.

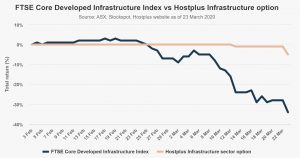

As at March 23rd, the Hostplus Infrastructure fund has a unit price of $1.02 compared to $1.07 in February, down 5%. That would suggest the portfolio has trounced listed infrastructure by 29%.

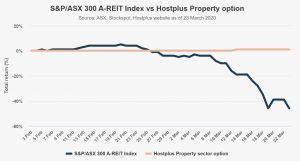

The unit price of the Hostplus Property fund is $2.11, up 0.6% since February. Has Hostplus managed to outperform the listed property index by a whopping 47%?

Members may not stick around to find out when they realise that they can still exit at high prices.

Those who remain in these funds won’t be pleased if the assets are subsequently written down to listed market levels and the loss is pushed from members who exited quickly to those who didn’t.

Whether unlisted assets truly live in their own valuation paradigm immune from market forces is going to become very obvious soon.

Hostplus boasts of having 1.2 million members with an average balance of $37,000. Many of these members work, or rather used to work, in the hospitality, tourism, recreation and sport sectors.

It is a fair assumption that most of these members are invested in the default Balanced fund. If 1 million members take advantage of the $20,000 super withdrawal window there could be $20bn walking out of this fund.

Selling the entire listed portfolio cannot fund this outflow.

END OF ARTICLE WRITTEN BY CHRIS BRYCKI

https://blog.stockspot.com.au/author/chris/

Stephen Lowry (CFP Professional, DFP, FAIM, AIF) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.