“But why can’t I have {insert any number of possibilities here} Mum?.” I’m surely not the only parent that hears this on just about every shopping outing. After all, I do have an 8-year-old that feels they need everything, right this instant.

Though it might be hard at the time, and I will undoubtedly be told just how lame I am because “every other kid” has one, I’m here to tell you why teaching your kids delayed gratification will help them 10-fold.

1. Teaching them patience – #1 trait of a good investor

Delayed gratification is patience put to the test. Now I know that teaching this to your little one can be extremely hard. In some ways, it really is baby steps. When they are very young, it might be simply explaining that they can have $1 today, or if they put it in a jar, they can have $8 at the end of the week instead of $7.

A little later, opening a bank account for them and giving them the option of having $7 pocket money per week in the hand to spend, or $10 per week in their bank account.

Then at the end of the year, it might be the option that anything that’s kept in the account is matched at 50c per dollar.

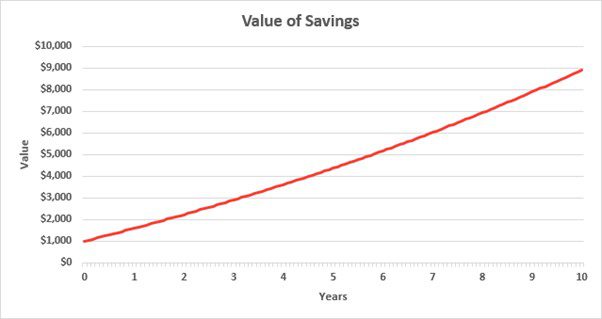

Later still, as they start to understand how returns on their money work, the option to start an investment account where their potential return is much higher, but with an understanding that they have to leave it there until they are a certain age.

Now we are all investors, so I don’t need to remind you about how patience is rewarded with return. But as a refresher, here’s a real-life illustration to show your kids:

2. Teaching them goal setting – 1st step of a good financial plan

By putting off the impulse purchase of that ‘thing’ that they just MUST HAVE today, what you are really teaching is the ability to set a goal for tomorrow. Understanding how to set goals, and then work towards them, is an invaluable life lesson for our youngsters. From the minute that they leave the nest, they will have a freedom that can be very dangerous on their money habits. The young adults that I see with money in the bank and a sense of direction and motivation about what they want in life typically have good goal-setting skills. They also have a higher likelihood of their financial plan working out!

3. Teaching them that happiness is not about things – learning their True Wealth

This one seems so obvious, and yet we can often overlook what’s important for what’s “now.” Showing our kids how to differentiate between the two ultimately leads to better health and behaviours (at least according to a study out of Stanford University in the 60s – you remember the one with the marshmallow on the plate and the child had to choose between 1 marshmallow now, or 2 in 15 minutes?). In lieu of things to distract them, kids have a remarkable ability to learn from the world around them, which may help them better understand what they really enjoy doing. Now I’m not advocating for an empty bedroom devoid of all toys by any means, but rather they’re being presented with the option that their hard-earned pocket money can be put towards that Nintendo Switch now or saved for something far more valuable later on.

Fast-forward 10 years:

Read Teneale’s next article: Kid Cash: Finfluence them

Teneale Laister (CFP® Professional, AFP®, BCom[Fin,FP,Mgt](Hons), ADFS[FP]) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.