Have you heard about the link between iPhone sales and incidences of deaths from falling down the stairs? The iPhone-stair death ‘effect’ is one of hundreds of ‘Spurious Correlations’1, identified by a Harvard Law student who created a website of the same name in which he charts ostensible similarities between different data sets to satirise the human tendency to mistake correlation for causation.

Some people may make the same mistake with investment, drawing cause-and-effect links between two variables and letting that drive their investment strategy. Take, for example, the idea that you should avoid the share market when the Reserve Bank is raising official cash rates.

Looking at 2022 in the Australian market, for instance, you might think that link has legs. The Reserve Bank of Australia (RBA) lifted the cash rate eight times, the fastest and steepest monetary policy tightening in decades. In the same year, the S&P/ASX-300 fell about 1.8%.

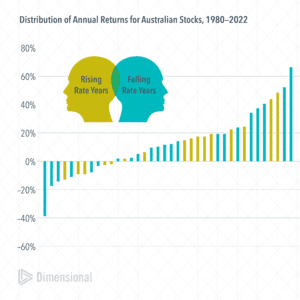

But a key rule with statistics, like walking down the stairs, is not to jump a step. If we look over a much longer period in Australia, 1980 to 2022—we see no obvious link. In years when rates rose, annual equity returns were as low as -12.9% and as high as 48.9%. In fact, some of the best annual returns, like 1985, have been in rising rate years. In years when rates fell, we see a similar wide range in annual equity returns, -38.9% to 66.8%.

Drawing conclusions about the relationship between rising or falling official interest rates and the equity returns is likely to be as productive as predicting stairway deaths from iPhone sales. As that Led Zeppelin song goes, sometimes all of our thoughts are misgiven.

RBA Cash Rate is obtained from the Reserve Bank of Australia. The S&P/ASX 300 Index (net div.) is not available for direct investment. Each year is categorised by rising (falling) rates if the RBA Cash Rate at the end of the year is higher (lower) than the RBA Cash Rate at the beginning of the year. Index performance does reflect expenses associated with the management of an actual portfolio.

Contributed by Warwick Schneller (PhD, CFA) Senior Investment Strategist and Vice President of Dimensional Fund Advisors.

1. ‘Spurious Correlations’, Tyler Vigen.

This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that has been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.