Superannuation – all workers have it. But why is it important to be engaged with your super?

Australia is one of the few countries in the world to have a “three-tier” strategy to retirement funding. Australian retirees generally rely upon some mix of:

- Personal savings;

- A Government pension (such as the Age Pension); and

- Superannuation (super).

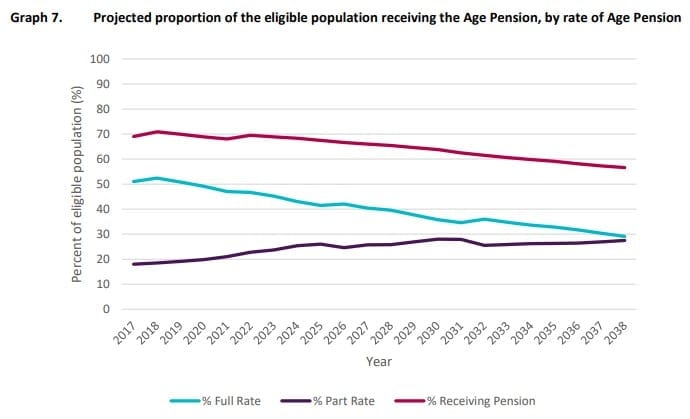

Whilst this is a robust strategy, funded by three streams (individuals, the Government, and employers), the Government pension represents a significant proportion of the total Federal budget each year. With a population shift occurring (meaning fewer taxpayers to support more retirees) and longer average life-expectancies, this is expected to see more strain placed on the Government pension moving forward. A Rice Warner report from May 2018 shows the expected decline in the eligible population receiving the Age Pension over the coming 20 years:

For the majority of the working population, this means getting involved with their superannuation is an important strategy for ensuring their retirement funding can be met.

But why superannuation? Is personal (non-super) savings enough?

There are certainly a number of benefits of super:

- Tax effective savings. Contributing money to superannuation can provide individuals with a number of tax reductions whilst they are working. In addition, any earnings and income on the fund throughout a member’s working life receive concessional taxation treatment (generally 15%).

- Disciplined savings. For many, the thought of your money being “locked away” seems scary – but here’s the upside. This is a great way to have a disciplined savings plan that cannot be “dipped into.”

- Tax-free income. When superannuation assets are used to commence a retirement pension, there is no tax on any earnings or income in the fund.

So now we know that superannuation is a tax effective, disciplined way to save for retirement. Generally, industry super funds are pooled together with other members’ money and invested on the behalf of all members. It is compulsory for employers to contribute to super on employee’s behalf (currently at 9.50% of Ordinary Time Earnings). There may also be additional Government benefits for eligible lower income earners.

What do I need to do?

It’s been shown that one of the biggest downfalls of the current super system is that the investments entered into via super are often “default” – and in many cases, it is on the employer’s recommendation as to which fund to enter into in the first place.1

Outside of how the money is invested, each fund has different rules around contributing, insurances, and estate planning (beneficiary nominations). The super system can be quite complex and seeking advice from a professional financial adviser to build a super plan based on your situation, needs and goals, is money well spent.

Teneale Laister CFP Professional, BCom(Fin,FP,Mgt), ADFS(FP), is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Alman Partners, nor its representatives, make no opinion on the subject matter or the subjects of the original articles. The case presented is for illustrative purposes only, and we encourage readers to form their own opinion on the matter.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.

1 https://www.pc.gov.au/inquiries/current/superannuation/assessment/draft