With a stark shift in US tariff policy announced on April 2 and ongoing responses worldwide, it’s not unusual for some investors to feel on edge as of late.

Sudden drops in the market and heightened volatility can be unnerving, as can rapidly changing economic policies. The market’s job is to process uncertainty in real time. When trade policies change swiftly, markets are incorporating a vast amount of information and expectations about how these shifts may shape the global economy. Markets do this on a forward-looking basis, continuously incorporating new information and setting prices so that expected returns are positive.

At Alman Partners, you’ll constantly hear us heeding caution in making drastic changes to your portfolio based on short-term volatility. In times like these, we encourage clients to think about the longer picture.

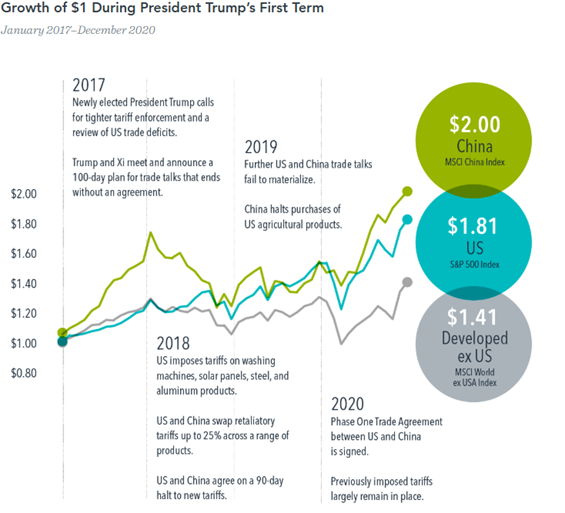

One period offering perspective on this issue is President Trump’s first term in office. Beginning in 2017, the administration eyed China as a target and, by 2018, began imposing tariffs across a range of products. The next couple of years saw back and forth trade discussions that eventually led to an agreement, though pre-existing tariffs remained in place. Despite all this uncertainty, both China and the US posted higher cumulative returns than the MSCI World ex. USA Index over the four years of Trump’s term.

Source: Dimensional Fund Advisors*

While we are not asserting that history is bound to repeat itself, we can take some comfort in the fact that the current market environment is not an entirely new paradigm that has never been experienced before.

Economic policies, such as those related to international trade, have financial impacts across the economy beyond market returns. The economic implications that markets almost instantaneously price into securities play out over a longer period in the real economy. This difference in velocity is important to underscore because it points to a difference in how we experience potentially negative (or positive) economic developments as investors versus as participants in the real economy. Even if you are worried about ongoing economic challenges, you shouldn’t necessarily expect a negative investment experience going forward, because markets have already factored in known information.

While drops in stock prices can be nerve-racking, markets have historically bounced back from downturns.

*In USD. Data shown from January 1, 2017, to December 31, 2020. Growth of wealth shows the growth of a hypothetical investment of $1. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment. Performance includes reinvestment of dividends and capital gains. MSCI China Index and MSCI World ex USA Index returns are net dividend. Tariff events data sourced from Reuters. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. MSCI data © MSCI 2025, all rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

James Alexander (GradDipFP, MFinP, BBus [Fin, Mgt]) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.