Almost weekly we have the pleasure of meeting with people who are embarking on planning their retirement. Invariably they are fit, happy and healthy, and looking forward to a new and exciting stage of life.

Important Considerations for a Successful Retirement

Whether it is retirement from a career role or the sale of a business, there are some important considerations in making this transition successful. Fortunately, we have had some experience in this area.

We have many clients who have transitioned to retirement, and what always strikes us is how happy they are and how genuinely rich their lives are. They are literally doing everything they want to do – in effect they are living their Ideal Lives.

When we work through their financial reviews together, we invariably have a conversation along the lines of how comforted they feel to be able to live well and feel safe in all market conditions. This is because they have more than enough capital as a buffer during good times and bad.

The Importance of Asking the ‘Big 5 Questions’

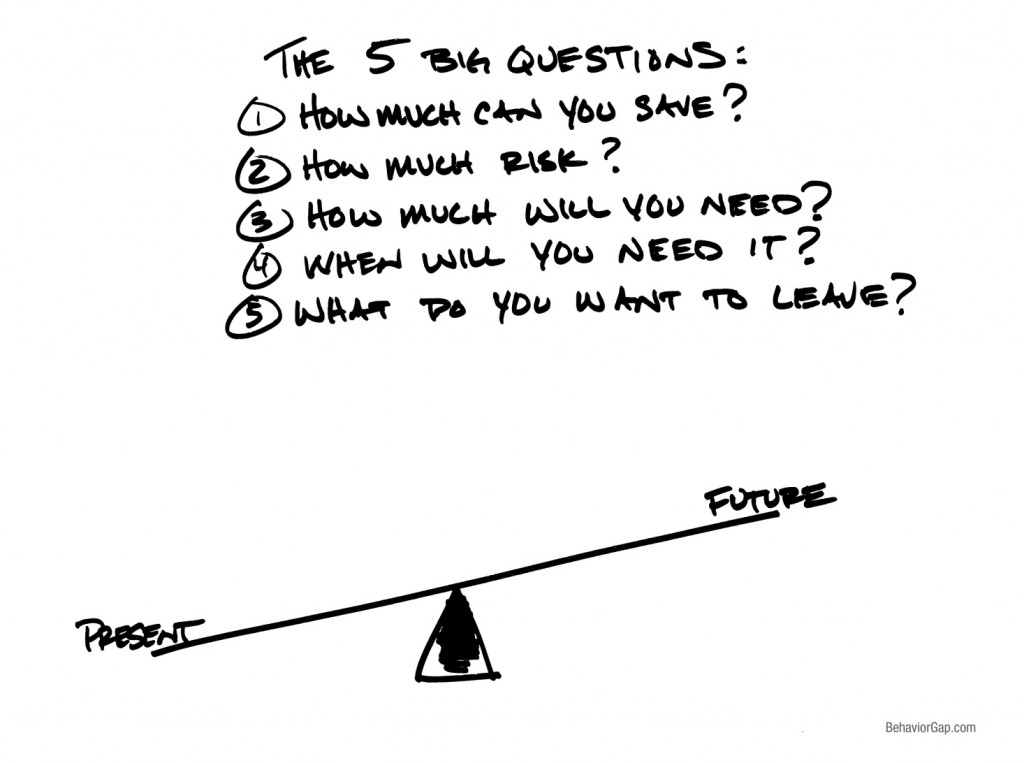

So how did they get themselves into this position? Well, having been with them on the planning journey we can safely say that they sought out answers to ‘the big 5 questions’ early enough in life to do something about it.

This is in stark contrast to others we see, who may have had the financial resources in the form of a high income, but they have not taken the time to ask themselves the important questions. As a result, opportunity passes them by.

The problem for these ‘others’ is when will they start the retirement planning process? Planning is all about trade-offs, dealing with the tension between living well today and saving for some event in the future.

This is where so many financial advisers let their clients down. Planning is not about the pursuit of the highest possible return. You will see that only one of these ‘big 5 questions’ relate to investment returns. The other four focus on the trade-offs we need to make to achieve a desired outcome.

Real Money Questions

So while investment returns are certainly important, the real money questions are the remaining four.

A good financial adviser will guide you through these questions, help you negotiate the trade-offs, set in place a strategy and most importantly, keep you accountable to the plan.

So how are you going with your ‘big 5 questions?’

Stephen Lowry CFP, DFP, FAIM, is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.