The 2024 Paris Paralympic Games are in full swing, and what an interesting couple of weeks watching Australia climb up the medal tally during the Paris Olympics, just a short time ago. Regular Olympic watchers will know the biggest medal hauls are traditionally won by one of a select few nations. But when it comes to global equity markets, country performance tables are much harder to predict.

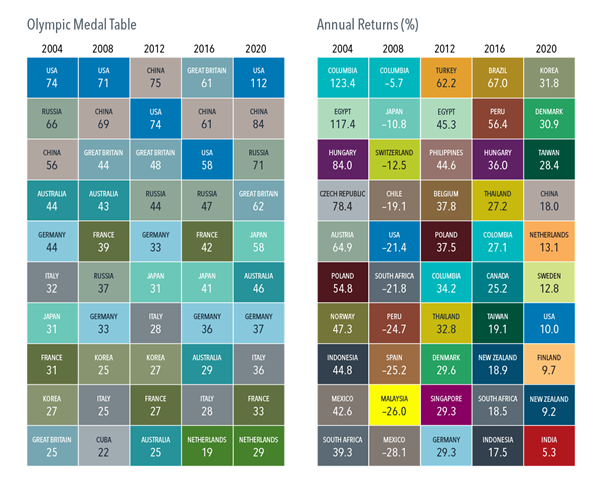

Since 2004, for instance, our exhibit below shows the USA appearing at the top of the overall medal table on three occasions, and second or third on two occasions. Other G7 nations and Russia usually feature near the top, although Australia has punched above its weight, placing in the top 10 in all the summer games in the past two decades.

In global equity markets, however, past performance is no guarantee of future performance. The bottom panel of the exhibit shows annual returns for various developed and emerging market countries for the year of each Summer Olympics since 2004. In fact, whether you assess it from one Games to the next or from one year to the next, it is hard to see any discernible pattern.

This means that while you may have a favourite country at the Olympics, when it comes to investment it makes sense to have a globally diversified portfolio. That way, you don’t need to predict which countries will deliver the best returns year to year. Holding stocks from around the world allows you to capture the top performers wherever they appear.

And just look at the choices. The global equity market offers exposure to more than 13,000 companies in more than 40 countries. As the gap between the best and worst-performing countries in any one period can be significant, a global portfolio helps mitigate country-specific risk, helps narrow the range of outcomes and can help improve the reliability of returns.

Best of all, being globally diversified allows you to stop worrying and enjoy the games.

Which Country Will Come Out on Top?

Source: Dimensional Fund Advisors

Jason Kirk (CFP® Professional, SMSF Specialist Adviser, GradDip. App.Fin&Inv, B.Econ) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.