While our existing clients are well equipped with investment education and a sleep at night strategy, despite what’s happening in our tumultuous world, we still notice the effect of volatile times on the wider public playing out time and time again.

When the markets are ‘up’, people are confident to invest but when the markets are ‘down’, we see this cool off some. So, let’s address why this may happen and provide you and your loved ones with the information and context to make smart financial decisions at these times.

Perceived Reality:

Increasing Inflation = Fear

Rising Interest rates = Fear

Behold, the Bear Market = Fear

Ok let’s face it, the above are not things to get excited about. Having said that, when you are focused on the emotions of fear and anxiety this can cause you to make wealth-destroying decisions or just as bad, no decisions at all. These very normal investor emotions can cause you to forget the bigger picture, and what opportunities may be ahead.

Reality:

Yes, inflation is high, and yes, interest rates are increasing with no line in the sand. Nonetheless, the bigger picture here is that increasing interest rates are aimed to control the overheated engine of the economy. Of course, in the short-term markets become volatile on the back of this uncertainty, and for the smart investor long-term expected returns increase.

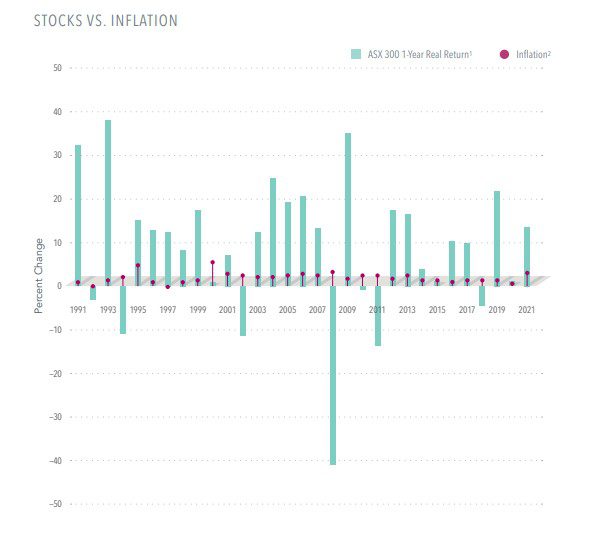

The good news is that inflation isn’t necessarily bad news for the share market and history has shown that stocks tend to outpace inflation over time. Whilst only relevant to the Australian Market the chart below tracks the 1 year returns vs the inflation rate highlighting that there is no reliable correlation between inflation and returns. As you can see below 24 out of 31 years saw positive returns even after adjusting for the impact of inflation!

Real returns illustrate the effect of inflation on an investment return and are calculated using the following method: [(1 + nominal return of index over time period) / (1 + inflation rate)] − 1. S&P/ASX data© 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Based on non-seasonally adjusted 12-month percentage change in Consumer Price Index for All Items in Australia. Source: Australian Bureau of Statistics.

As for the Bear Market, Warren Buffet commented once that:

Now can you imagine going shopping and seeing a garment on the sale rack or milk on a redlight special but deciding not to buy because you are waiting for it to go full price! Waiting for it to come off sale would be illogical. It is the same principle when you make investment decisions.

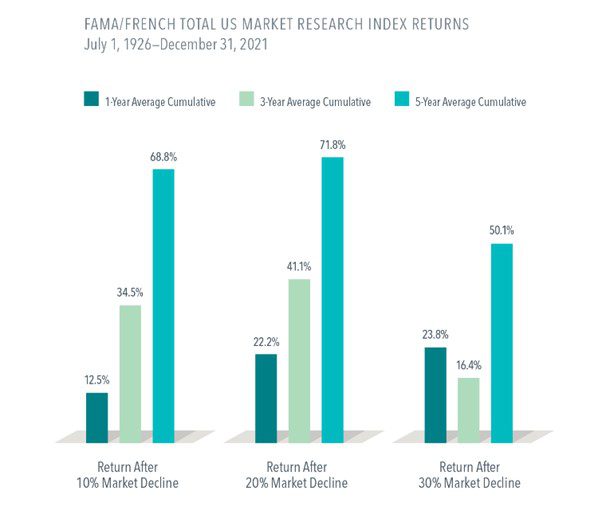

Negative returns are also normal. In fact, that data shows us that even after a 30% market decline, within 1-3 years markets had fully recovered, followed by an impressive 5-year return!

1 S&P data© 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment.

Even if we are heading for (or are already in) a recession, they are always identified with a lag, and so by the time a recession is confirmed, markets are often on their way to recovery. That’s another argument for staying disciplined over the long-term and sticking to a well-constructed financial plan which makes allowances for periods like the present.

‘’If there were no uncertainty, there would be no return. And while the good times don’t last forever, neither do the bad. Over the long-term though, markets have performed exceptionally well’’

Opportunity:

The opportunity here is to save someone you care about from making the mistake of ‘waiting it out’ before they make real decisions around their financial future. The opportunity is in doing something today that could have been put off until tomorrow so that you don’t miss out on what long-term markets have to deliver. In theory, expected returns are also higher than what they were before the doom and gloom.

Now is the perfect time to reach out to our highly qualified financial advisers to help tame those irrational investor behaviours. When you have a trusted adviser in your corner it’s a bit like having a sailing boat skipper who knows how to set the sails to deal with shifting winds and choppy seas.

In line with our mission to Lead, Educate and Inspire, we ask that if you know of anyone suffering from investor fatigue or even feeling this yourself, to contact our team for a confidential discussion.

Kelsey Dent (DipFP, ADFP, BA Hons [Bus,Mgt]) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.